Capital gain tax in Costa Rica began on July 1, 2019. The previous law only applied capital gains tax to real estate developers that were in the business of developing and selling real estate. Everybody else was exempt. Recent changes to the Costa Rican tax laws implemented Capital Gain Tax (Ganancias de Capital) which has a lot of variants. Capital gain refers to gaining equity on your property, so basically making a profit at the sale of the property.

When do I have to pay the tax?

The tax has to be paid on or before the 15th day of the month following the closing date. You will need to hire an accountant to do the calculation for you.

What if I donate my property to somebody else or if is it transferred by inheritance to my childen, spouse or somebody else?

In such cases, the tax is not paid but will be when the new owners will sell it.

How much it will cost when I will sell?

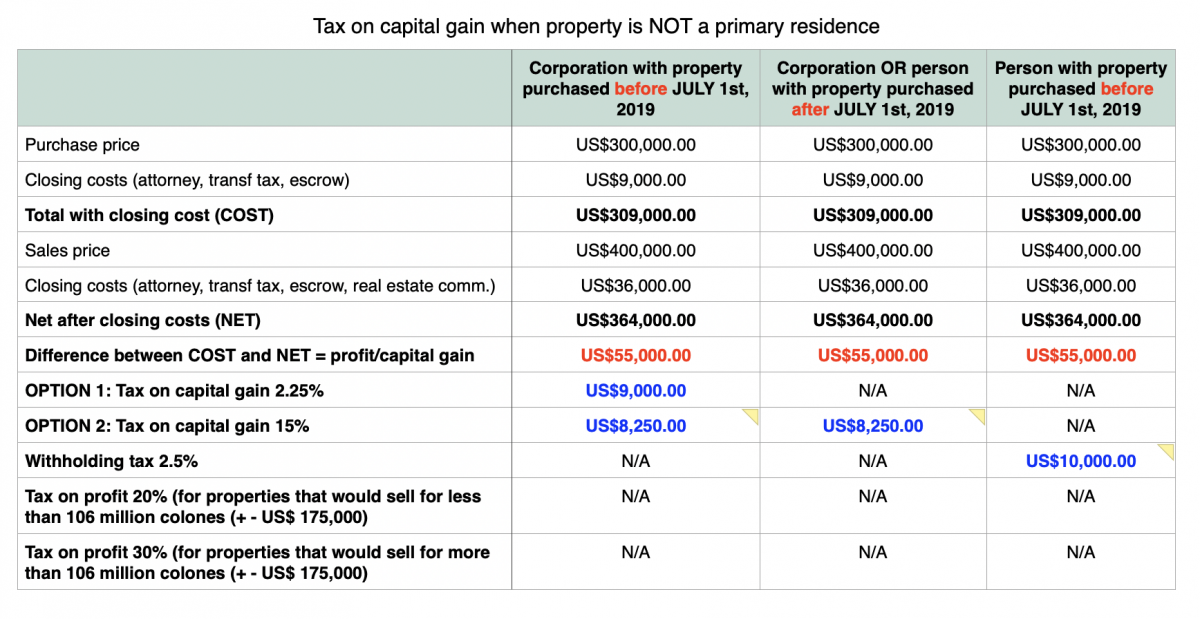

If you spend more than 183 days in the country and you are not renting your property because you live there, it is considered your primary residence and it is exempt from capital gain tax. The primary residence can be registered in the seller’s personal name or a Costa Rican corporation. If you don’t spend 183 days in the country, you are considered a “foreign non domiciled” and will have to pay a tax on capital gain. We made this calculator below to help our clients figuring out how much they should expect to pay if they sell their property. We took the example of a property purchased for 300,000.

Use the calculator for capital gain tax:

- when property is NOT a primary residence (A foreign person will be considered domiciled if spend more than 183 days in Costa Rica)

- when we transfer the property at closing (not the shares of the corporation)

- when the active corporation is a “passive income corporation” based on Chapter 11 of the reform (no employee on caja, simple rental income property)

* Capital gains tax law involves many more details than this page can cover. It is very important to consult with an attorney and accountant in order to get the right calculation based on your situation.